UK Housing Market Resilient as Wider Economy Stutters

Posted by Knight Frank Newcastle on 6th August 2025 -

The story of the UK economy this year can be divided into three chapters.

First, there was a flurry of activity in the first quarter as businesses rushed to get ahead of US trade tariffs and domestic tax hikes in April.

This was followed by an inevitable slowdown as markets paused for breath.

The third chapter has been the recovery, but so far it has fallen short of expectations.

GDP, retail sales and employment data have all disappointed as businesses contend with economic uncertainty. The latest GfK sentiment survey suggested consumers are essentially adopting the brace position ahead of further tax rises in the autumn Budget.

This summer certainly has echoes of 2024, where many played a seemingly endless game of ‘guess the tax rise’ before the Budget.

The residential property market has followed a similar pattern, with a stamp duty cliff edge in April producing a few tumbleweed moments before the recovery kicked in.

I discuss all of these topics and more in the latest edition of the Intelligence Talks podcast with Pepperstone analyst Michael Brown. Other subjects covered include wealth tax rumours and the upwards pressure on mortgage rates as the profile of UK bond-holders changes.

Happily, the recovery in the property market has been better than expected a few months ago and more convincing than the one taking place in the wider economy.

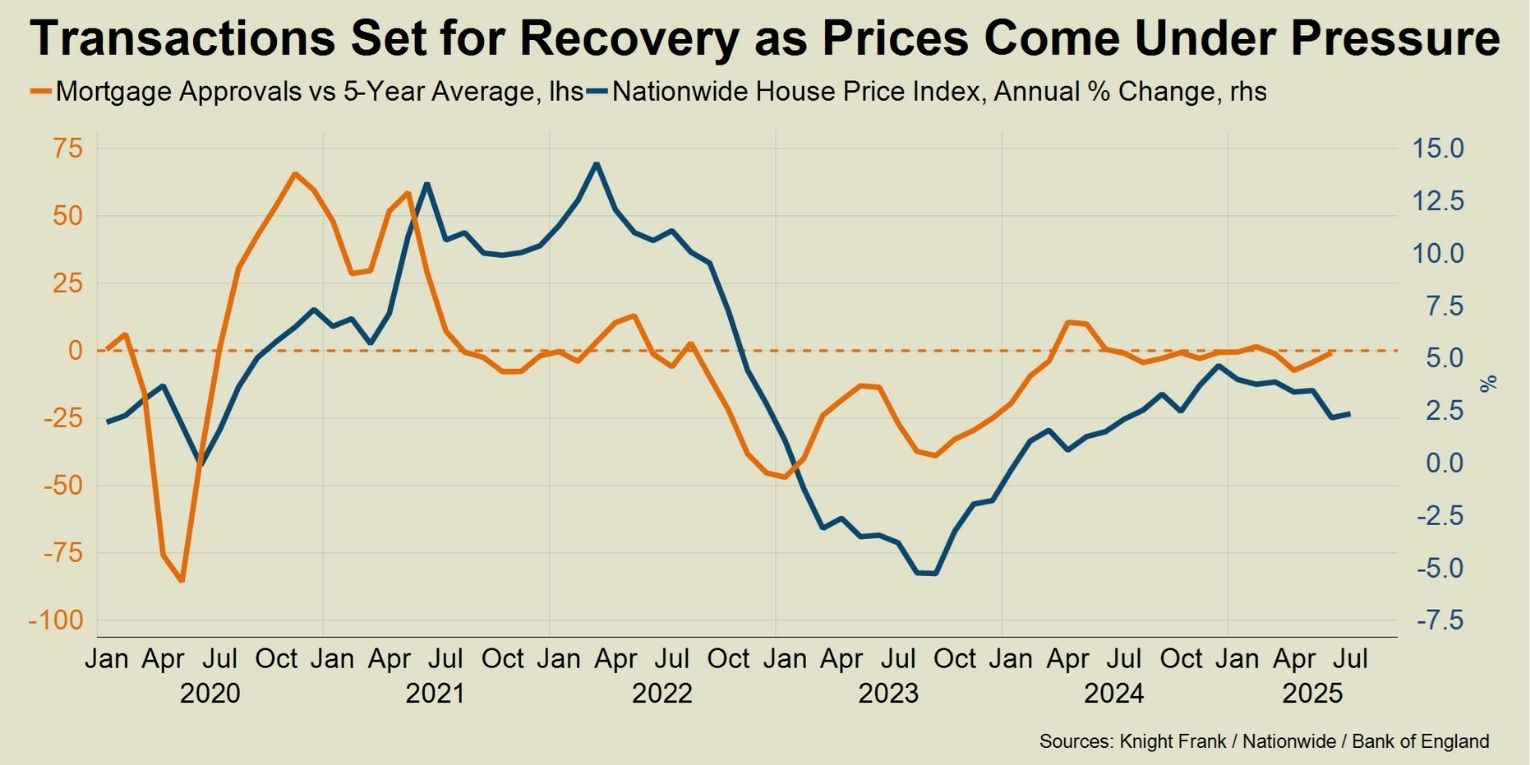

The number of mortgages approved in June was virtually in line with the five-year average, Bank of England data showed last week.

Swap rates have edged higher in recent weeks as inflation expectations have risen, however they remain at similar levels to last October, shortly before the Budget. The choice of sub-4% mortgages has therefore been wide enough to support activity.

It’s not necessarily the case in discretionary, higher-value markets, as we explored last week.

“It’s still a very price sensitive market but June and July were better than I thought they would be at the end of May,” said James Cleland, head of the Country business at Knight Frank.

However, supply is still outweighing demand fairly notably.

There were 5.7 new buyers in the UK for every new property coming to the market in Q2, Knight Frank data shows. The ratio hasn’t been this low since early 2018, when there were jitters surrounding a no deal Brexit.

The fact it is such a buyers’ market means asking prices need to be realistic, which remains true despite the modest rebound in annual growth reported by the Nationwide on Friday (see chart).

The overall weakness in the UK economy means a rate cut this week by the Bank of England is highly likely, with markets pricing in a further quarter-point cut in November.

The headache the Bank faces is that inflation has been more stubborn than expected, for reasons that include higher public sector pay awards and steeper employer national insurance costs feeding through to prices on the shelves.

However, headline inflation should start to fall from its current level of 3.6%, said Pepperstone’s Michael Brown, particularly as one-off changes around fuel prices work their way through the system.

“The problem, three or four months from the Budget, is that we don't really know where further tax hikes will come from,” he said on the podcast. ““We're at a delicate spot where we may just get over one hurdle and then there's another one placed right in front of us.”