Number of SME Builders Plummet 80 Per Cent Since Late 80's

Posted by Sirius Property Finance on 10th November 2021 -

Defined as small to medium-sized housebuilders, SME developers typically deliver between one and 1,000 homes to market on an annual basis, with a focus on smaller projects compared to the big names in the sector.

In February of this year, the Government’s housing accelerator, Homes England, together with United Trust Bank, announced a £250m fund aimed at supporting SME builders – with the additional carrot of development finance up to a 70% loan to gross development value.

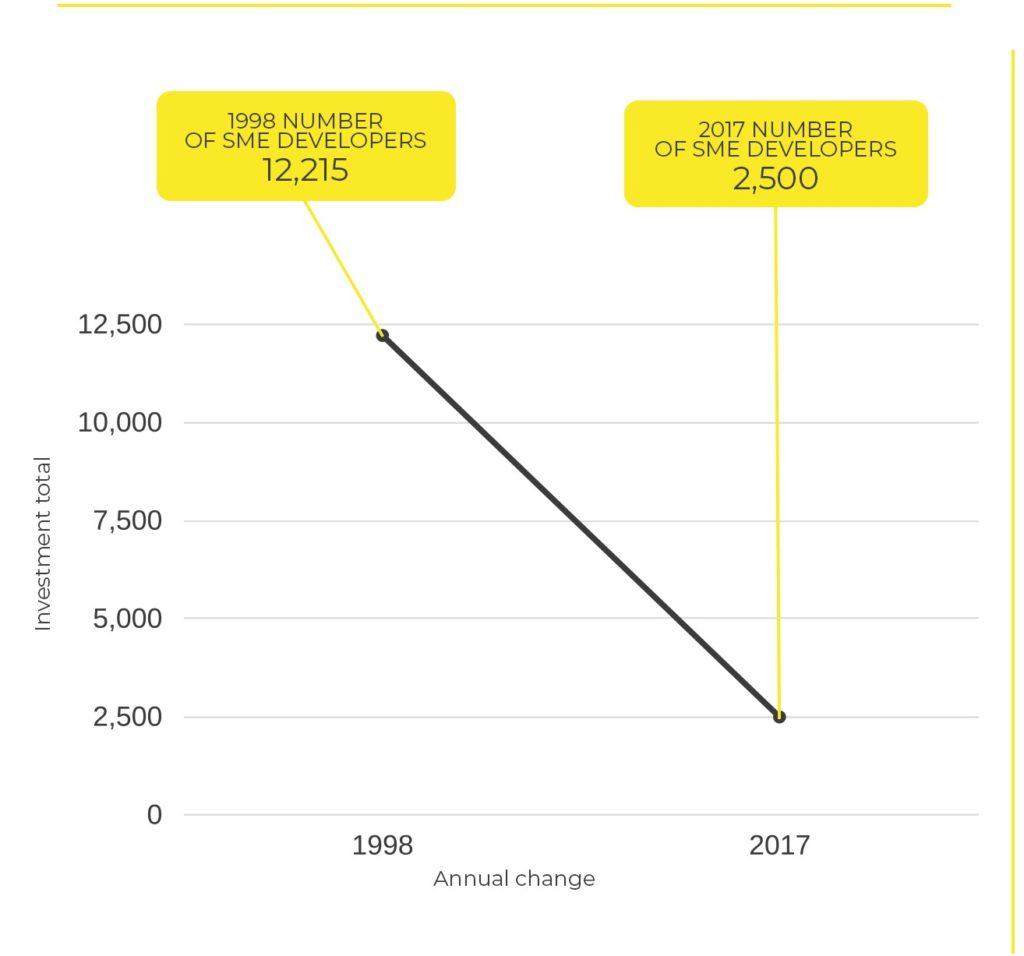

The estimated number of SME Developers and how this has changed between 1988 and 2017:

The data shows that in 1988, there were 12,215 SME developers operating across England delivering 77,524 new homes to the market. However, in 2017 this number was down to just 2,500. That’s an -80% reduction since 1988 at a rate of 335 SME developers a year (-2.7%).

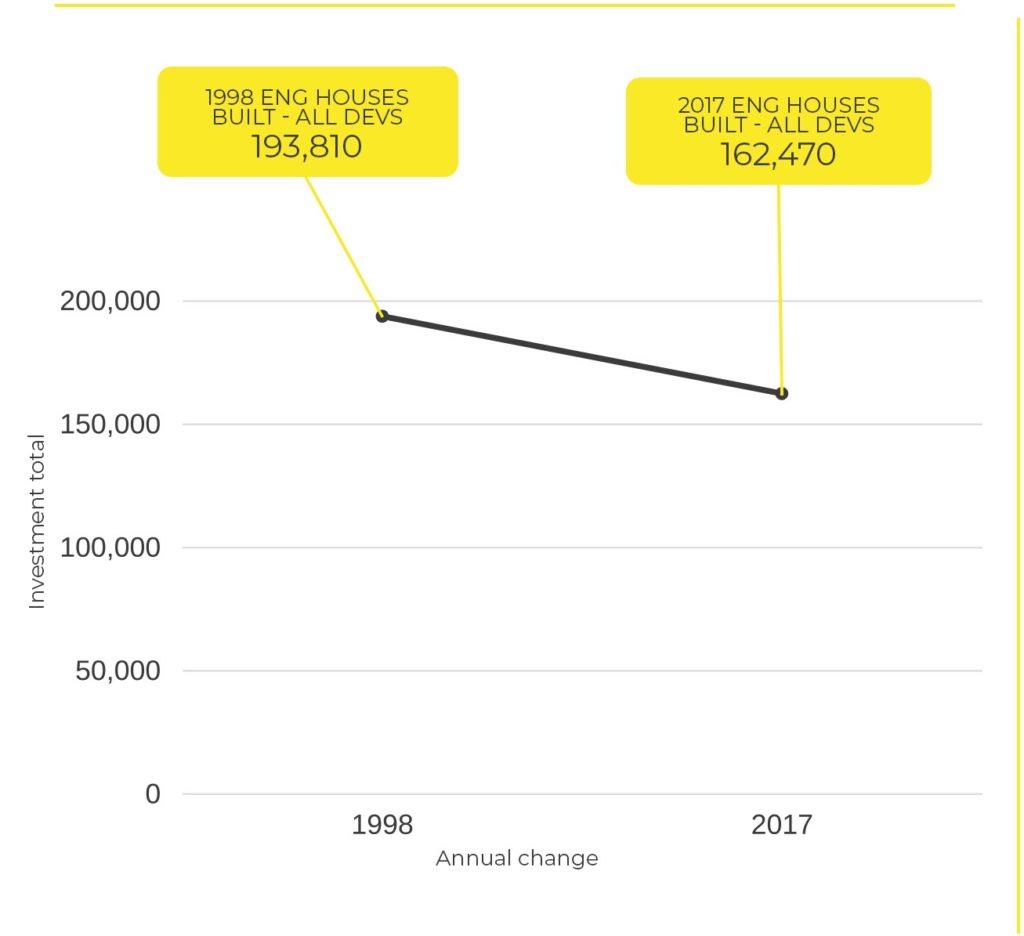

The market share of SMEs all new homes built in 1988 and 2017:

The number of new homes built on an annual basis by SMEs has reduced by 40% in 1988 to just 12% today. The only silver lining is that far higher new-build house prices mean the value of this 12% is higher than the 40% build back in 1988 at almost £5.8bn.

It is important to note that SMEs have faced various challenges between 1988 and 2017 including red tape barriers around finance and planning, a reduced level of opportunity due to not one, but two financial crashes, complicated public procurement processes and most notably, growing competition from the big housebuilders.