Modular Buildings Potential Savings for Property Developers

Posted by Sirius Property Finance on 25th November 2021 -

Modular Buildings Could Save Developers Hundreds of Thousands of Pounds in Funding Interest

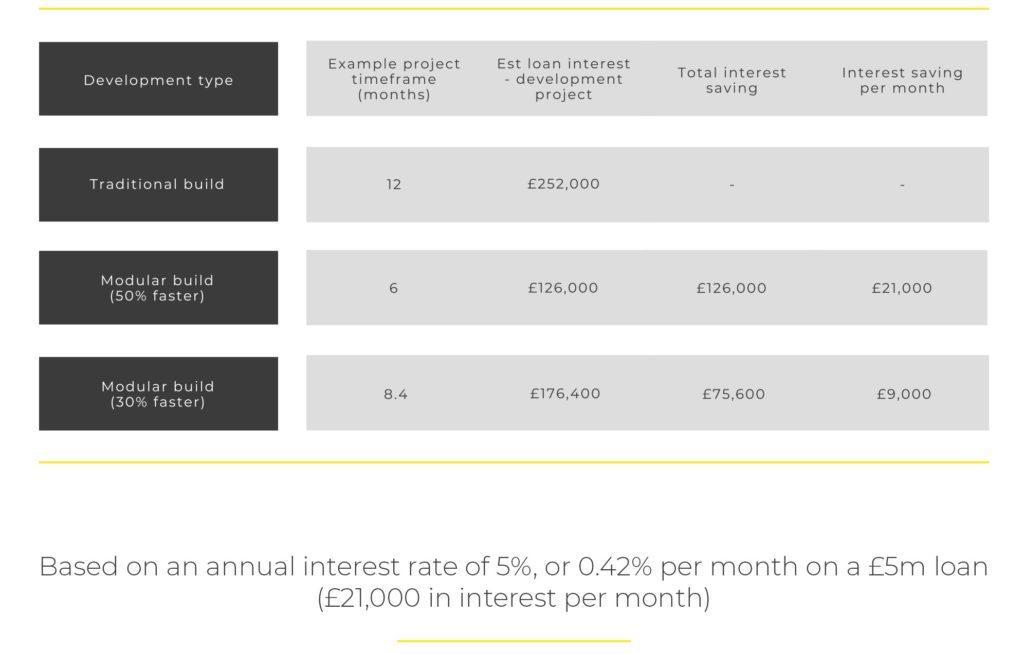

On average, the estimated annual interest on development finance sits at approximately five percent per annum – around 0.42% per month.

Based on the loan amount of £5m over one year, property developers opting for the traditional route to build would see £252,000 paid in interest in over just 12 months.

Opting for the modular build route could see construction complete 30% to 50% quicker than a traditionally built development.

By reducing this construction time by 30%, developers could see an interest saving of £75,600 in a single year – £9,000 per month.

However, by cutting this timeframe by 50%, this saving climbs to £126,000 per year or £21,000 per month.